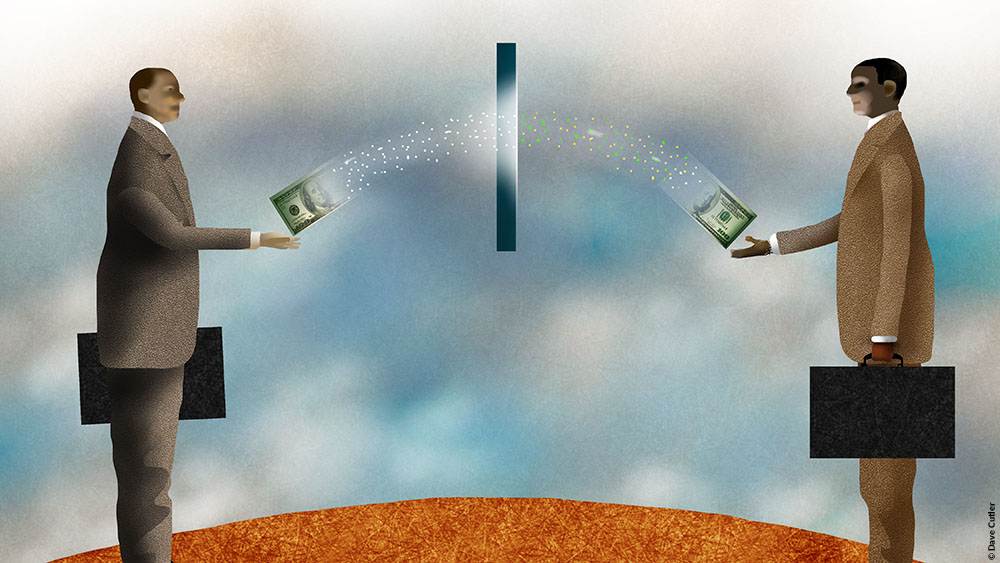

If your company is in the B2B sector, chances are you have a high volume of business. One of the many headaches commonly associated with dealing with other businesses is payment processing.

Many times, the costs and time associated with printing, signing, and mailing checks to various businesses can severely cut into your other responsibilities when it comes to managing your company. Here are five benefits to outsourcing your B2B payments to another company.

Outsourcing payments offers security

One of the number one reasons to look into another company while adjusting your payment processing is security. When you choose a company such as Smart Payables Payment Outsourcing, you get reliable security. These companies are often PCI compliant and HIPAA certified, and they offer a variety of features to make their check printing more secure.

These features include chemical sensitivity, controlled paper stock, and even thermochromatic ink. These types of features let you rest easy, knowing that your payment processing is in safe and capable hands.

Your business gains value

Another major benefit to outsourcing your payment processing is the value your business will gain as a result. Invoicing and collecting payments, cutting checks, and mailing out recurring payments all take up valuable time that could be spent on other tasks.

When you outsource your payment processing, you truly get to live with payments out of sight and out of mind, with invoices readily available each week so you know what payments have been made.

Outsourcing payments allows for automation

Automating various aspects of your business is an excellent way to increase efficiency, and nowhere is that truer than in payment processing. Automating payments electronically offers you one less task to think about each week, whether you use ACH or direct deposit.

In fact, many payment solutions even scrub payments through ACH before they are sent, allowing you to identify and avoid bad routing numbers. This can save a lot of time and headaches when it comes to reprocessing payments.

You can quickly get reports

Receiving reports on your current and outstanding payments is another reason to consider outsourcing who handles your payment processing. Quality reports are secure and comprehensive, and most options allow you to run reports that are closed-loop for use with your bank.

Alternatively, you can use your bank’s reports in conjunction with your processor’s reporting system. Whatever method you choose, the process is intuitive and streamlined, allowing you to focus on the aspects of running your business that most require your brainpower.

You can focus more on your business

One common thread between all of the above benefits of payment processing is the way that it allows you to focus more on running your company. The B2B sector is complex and requires a multifaceted approach that works best when it isn’t bogged down by routine clerical tasks like payment processing.

Alexander Graham Bell famously encouraged others to “concentrate on the task at hand,” since focus is so important to achieving your goals. By removing one tedious task from your plate, you can focus on other, more pressing, matters and ultimately grow your company even more.

Payment processing can be complex, but it doesn’t have to be; at least, it doesn’t have to be complex on your end. By outsourcing your processing to another company, it’s possible to regain valuable time and ultimately run your business more efficiently. From improving your company’s security to offering powerful automation features and reporting, there are many reasons to consider outsourcing your payment processor.